I’ve been shivering for the last month because of the credit card bills for travel.

Today is all about cash for travel.

Basically, credit cards are accepted everywhere in Europe, so I try to pay by card as much as possible, but even so, cash is fast, convenient, and perfect…

These days, I exclusively use credit card cash advances for local cash.

Now, the commission is very interesting, and I believe that it is much cheaper than exchanging money in Japan or at a local exchange office.

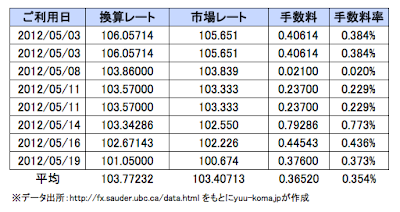

I did the calculations based on my credit card bill.

The “conversion rate,” “market rate,” “fees,” and “fee rate” for each of the cash advances I used on my main Citi card were as follows

Oops, by the way, the rate is Euroyen, of course.

- 「換算レート」とは、実際にカード請求時に確定するレートのこと。つまり100ユーロのキャッシングをした場合、請求額は100ユーロ×換算レートとなるわけです。

- 「市場レート」とは、為替市場で取引されているレートのことです。各項目の市場レートはカード請求の日時と同日のものをピックアップしています。

- 「手数料」とは、「換算レート」と「市場レート」の差です。

- 「手数料率」とは、「市場レート」に対する「手数料」の割合です。

I’ll take a rough average.

手数料の平均値:0.36520円

手数料率の平均値:0.354%

きちんと街の両替所を調査したわけではありませんが、おそらくクレジットカードによるキャッシングのほうが圧倒的に安いと思われます。やっぱりキャッシングが一番いいのではないでしょうか。

I wonder what kind of guidebook still says that traveler’s checks are good or something. I wonder if it’s true (laughs)

Please note that cash advances can only be used in countries where credit cards are widely accepted, of course.

By the way, it’s a small thing, but exchange rates are traded 24 hours a day, and the price changes, so the number changes depending on what point in time you take the value.

Since it would be too much to discuss in detail, I used the following data obtained from the following site under the following conditions.

こちらのサイトなかなか便利ですねー。