第一回 Bitcoinをはじめてみました No.1、第二回 Bitcoinをはじめてみました No.2の続きです。(今回で最後です。)

11. I deposited Japanese Yen to the exchange.

We use a rather unfortunate and primitive method of transferring funds to an account designated by the exchange. Naturally, since it is a bank transfer, it is not available 24 hours a day, on weekends and holidays. It can be said that it can’t be helped because it is a real currency, but it would be nice if it could be improved a little more.

Depending on the exchange, you can get a basic confirmation of your deposit right away. To start with, I deposited on both coincheck and Quoine. Quoine is a Singaporean company, so they didn’t confirm my deposit until around 12:00 noon. If you don’t put some money in beforehand, it might be troublesome.

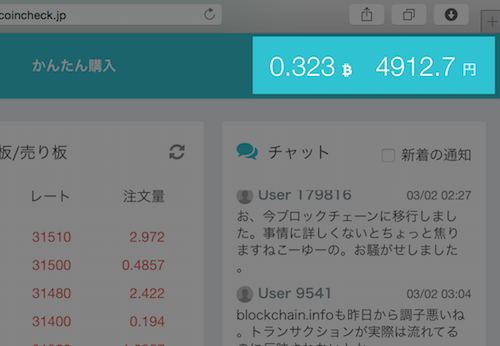

12. I tried to get bitcoin on an exchange.

You can trade bitcoin as soon as your Japanese yen is deposited into the exchange and your balance is reflected in your dashboard.

The first thing I did was to start trading on coincheck. I wanted to try to get some bitcoin first, so I went for it without worrying about the bitasq spread, though it was a limit price.

これが人生初のビットコイン!

13. I transferred bitcoins from an exchange to my wallet.

Once you have obtained bitcoins from an exchange, you can now transfer them to your wallet. This is where the bitcoin address comes into play. I knew this from reading books and such, but once you actually start using the wallet, you’ll understand it immediately.

“It is said that you should change the bitcoin address you use for depositing and transferring money each time, but don’t you think this is a bit of a hassle? In fact, you can easily create any number of bitcoin addresses.

The blockchain.info wallet allows you to create bitcoin addresses as many times as you want at the touch of a button.

Bitcoin addresses can be created randomly in this way. And of course, if you create a bitcoin address in your wallet, it will be sent to the same wallet even if it is different each time. It’s very secure.

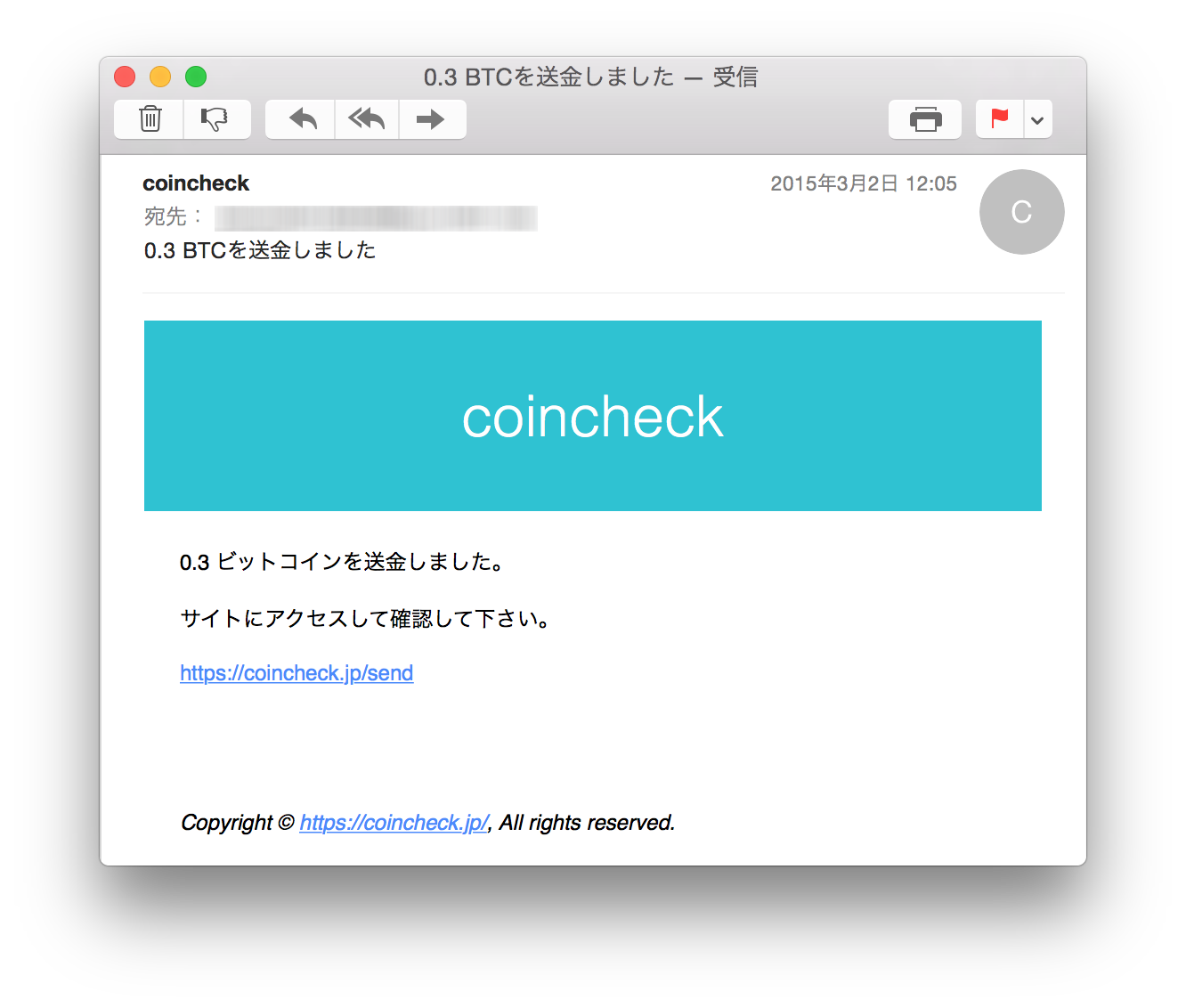

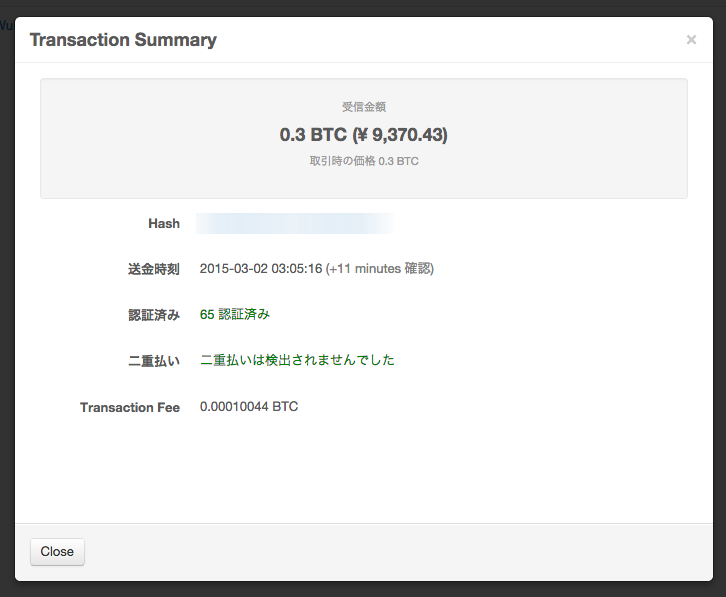

Now, to deposit Bitcoin into your wallet using this Bitcoin address, enter the Bitcoin address you issued in your wallet into the appropriate field on the exchange’s money transfer page, or actually copy and paste it. After that, you just need to enter the quantity of Bitcoin you want to transfer and press the confirm button.

By the way, the fee for sending bitcoin was 0.0002 BTC. It seems to be fixed, so it might be expensive if you send only 0.3 BTC at most, but it’s still very cheap because it’s about 10 yen at the current rate.

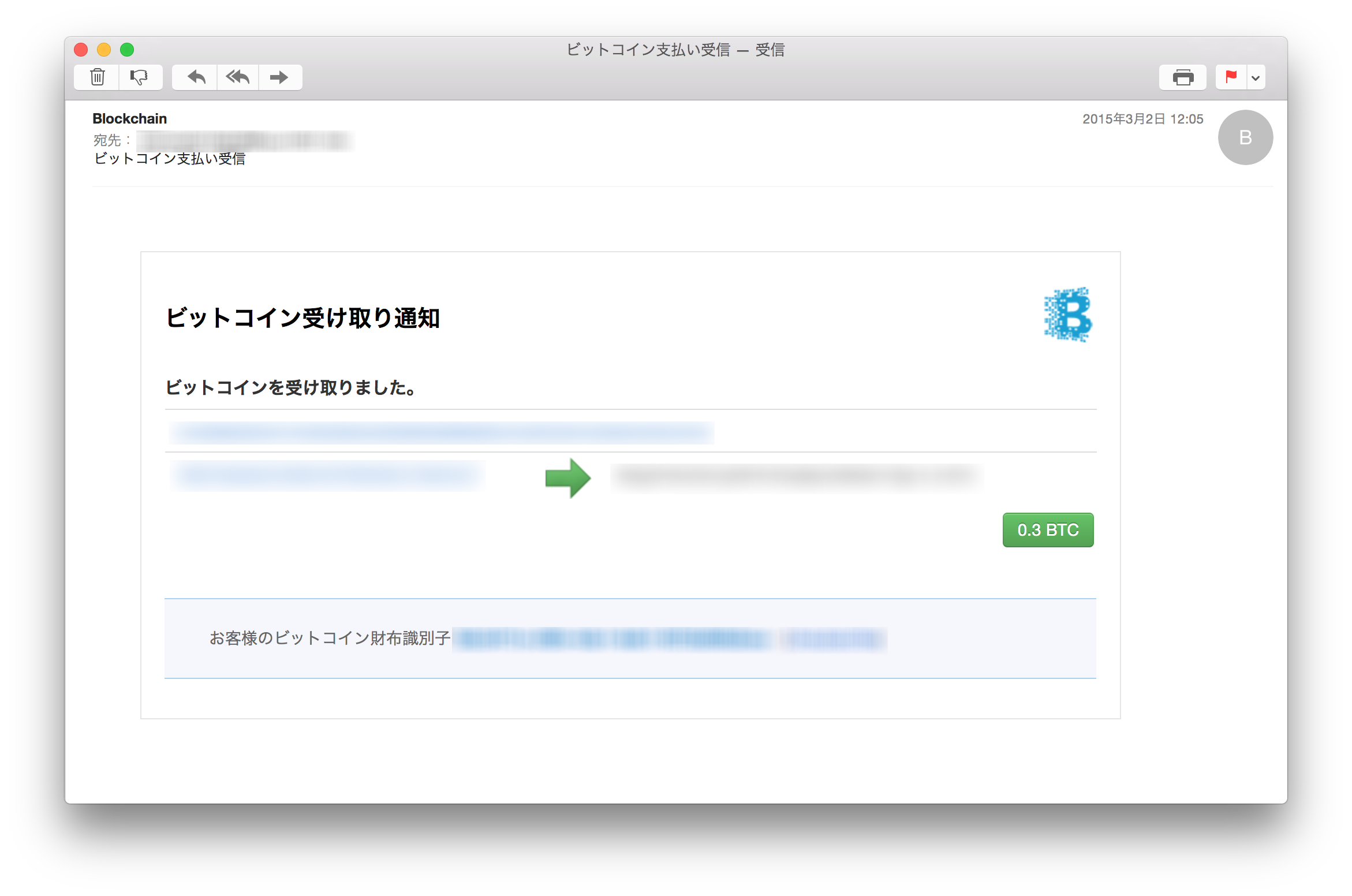

Once the transfer is complete, you will receive an email from the exchange. coincheck sent me an email right away. I think it was within 1 second after sending.

And the reflection to the wallet is also fast, about a few seconds.

Now I also tried it with Quoine. This one has zero money transfer cost. Is it a good deal? I thought it was a good deal, but it took a long time to make a deposit. It took about 2 hours to be reflected after all.

Is it being done manually by the exchange? Or maybe they don’t have a position right away, and are repricing after the withdrawal process? But if it’s the latter, the holder’s permission is generally required, so I’m sure it’s being done manually by someone inside. I don’t think the conventional wisdom applies to Bitcoin, though…

In addition, there seems to be a story that it is the influence of the case of Mt.

In any case, zero cost is attractive, so let’s hope Quoine’s future is good.

14. it takes 10 to 15 minutes to approve a transaction

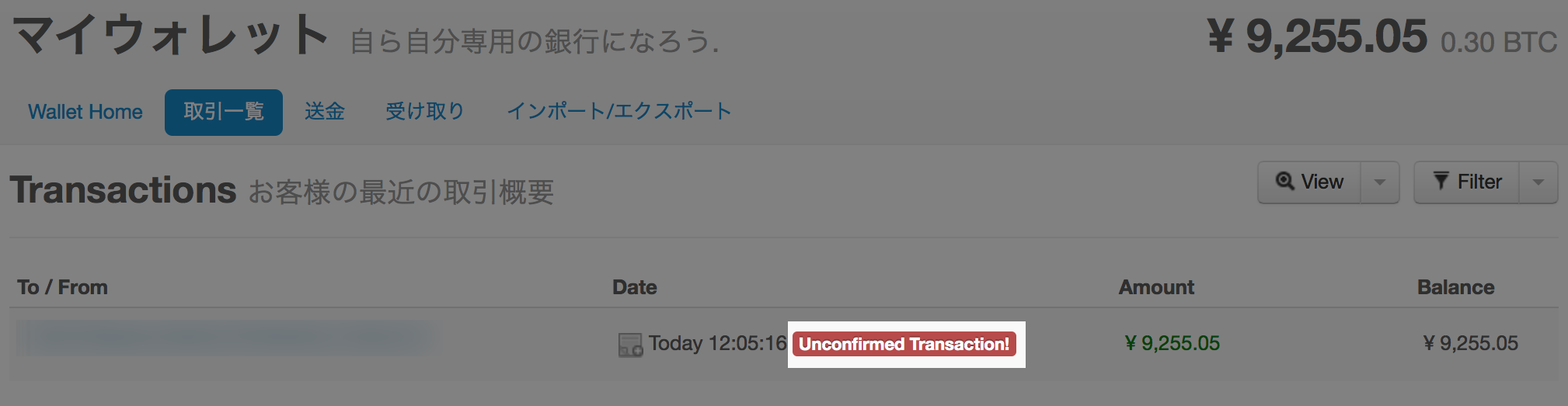

Now, I logged into the wallet again to see if the bitcoins were transferred without any problems.

Apparently, the money was transferred without any problems…

「Unconfirmed Transaction!」となっています。実はビットコイン、取引成立までには10分から15分ほどかかるという性質があります。

This is because in Bitcoin, a process called “approval” is done. This process, in general, is said to take about 10 minutes.

bitcoin.orgから引用しますと、

“承認とは、取引がネットワークで処理され、取り消されることはほぼないという意味です。取引が ブロック やそれに続くブロックに含まれた時、承認を受けます。”

そして、具体的に承認はどう行われるのか、それが「採掘:マイニング」です。

“採掘は、分散型合意システムでありブロックチェーンへの取り込み待機中の取引を承認するために使用されます。採掘は、ブロックチェーンの時系列を強化し、ネットワーク中立性を保護し、最先端のシステムでコンピュータ同士の合意を可能にします。”

It’s true that it was written in books, but I finally understood the meaning of it after actually handling it myself.

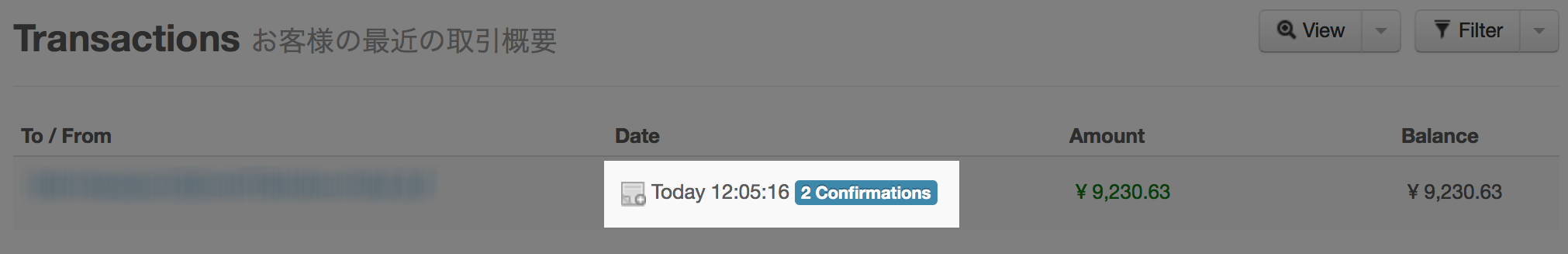

Then, about 15 minutes later, I checked back in the wallet.

Indeed, it was “Confirmed”. The number of approvals has increased over time.

I have now completed the entire process of converting Japanese yen to bitcoin. I was a little nervous at first, but once I understood how it worked, it wasn’t too difficult and I think I was able to do the transaction successfully.

15. risks of bitcoin

Now, let’s take a look at some of the common risks associated with bitcoin and consider the possible risks in Japan. Risks such as those caused by cyber-attacks on transactions themselves or wallets have been introduced in many other books and websites, so I will omit them here.

「その1:市場リスク」

市場性のある商品ですから当然あります。2013年1月3日からから2015年3月1日の期間で計算したBTM/USDのヒストリカルボラティリティは96.67%(出所、日次データ年率化、価格取得時間は毎日次18:15)、これは、USD/JPYの6.67%(出所、日次データ年率化、おそらくWTMロイター?)をはるかに上回っております。一資産として、資産運用対象として捉えるならば、ある程度は抑えておきたいリスクです。

This risk is only enough for me to be troubled if the purchase price rises in the future due to a sharp rise in the price, especially since I have no intention of using it for speculative use or asset management at the moment.

「その2:日本国内で普及しないリスク」

In the first place, there is the question of whether there is any use for bitcoin even if it is obtained. It is true that bitcoin and other virtual currencies are becoming more and more popular worldwide, but what will happen in the future is a question that each individual should deal with on his or her own responsibility.

In terms of Japan, whether it’s the national character or the lack of proper reporting on the nature of Bitcoin by the mass media, it seems to be lagging far behind the rest of the world, but I personally don’t care too much about it. It’s a very optimistic view that has no basis in fact, but Japanese people love electronic money and are used to using PASMO, SUICA, and other electronic money, so I believe that as bitcoin becomes more popular around the world, it will naturally spread to Japan as well.

This risk is mainly for use in overseas travel and e-commerce sites, so I personally do not think it will be much of a problem even if it does not spread in Japan.

「その3:承認までに時間がかかるリスク」

I think this is another reason why it is hard to spread. It would certainly be unrealistic to have to wait 10 minutes when paying with bitcoin at a store, restaurant, etc.

This approval itself is a fundamental concept and mechanism of Bitcoin, so it is unlikely that it will ever disappear, but there is a good chance that it can be solved from a technical and institutional standpoint, such as by providing 10 minutes of trust before approval.

I personally don’t think it’s a big risk if we expect progress in both technology and business.

Incidentally, I would like to know the probability of a transaction being disapproved or double-dealt. I don’t know as I am uninformed at the moment, but are these figures published?

「その4:取引所が破綻してしまうリスク」

As long as Bitcoin continues to grow in popularity, I don’t think it’s a big risk as long as you can choose a safe and reliable private exchange at your own risk.

You can also reduce the exchange risk itself by using a number of exchanges.

And as long as you understand the difference between a wallet and an exchange, deposit bitcoins exchanged on an exchange as appropriate into your wallet, and strictly manage your wallet, the risk of exchange failure is not a direct risk.

I consider this risk to be almost non-existent for me, as it is avoidable enough if you manage your wallet thoroughly.

「その5:取引所での日本円両替ができなくなるリスク」

On the other hand, there is a risk that there will be no more exchanges that support Japanese yen and can handle Japanese bank transfers. For the average person, it is almost impossible to acquire bitcoins through mining, so a means of exchanging bitcoins for real world currency is very important.

For Japan, in particular, the survival of exchanges that can ensure the transfer of Japanese yen from Japanese financial institutions to the exchanges is a matter of life and death in the use of bitcoin. At the moment, Japanese exchanges are the only ones that make it easy to exchange Japanese yen for bitcoin.

In this sense, the domestic spread of bitcoin is highly anticipated.

But this risk also depends on the closed nature of Japanese financial institutions. The same can be said for conventional financial institutions worldwide. Even though it is developing, it is still just a virtual currency. You can’t beat reality.

しかし、これについてもまだ将来性はあると思います。少なくとも現時点では、非常に割高ではあるものの、個人間での取引(LocalBitcoins.com)やPaypalでの支払いに対応しているサイト(VirWoX)もあります。このあたりがもっともっと発展することで、手数料も下がり利用しやすい環境になることを期待して良いと思います。

In any case, for now, it is better to get it through Japanese exchanges.

このリスクは、これまで紹介したもののなかでは、私にとって最も影響が大きいと考えています。近い将来、もっと出来高の多いグローバルな取引市場、例えばBitstampなどの利用も検討したいと考えています。

「その6:取引所がサイバー攻撃を受けたため発生するリスク」

This is considered to be the same risk as in “Part 4: Risk of Exchange Failure”.

「取引所の自己責任による選択」、「利用取引所の分散」、「ウォレットと取引所残高管理の徹底」、この3つを徹底することで十分軽減可能なリスクです。

Like #4, I don’t see it as a big risk for myself.

「その7:取引所が不正をするリスク」

The Mt.Gox example is exactly this pattern. However, we believe that the basics are the same here as in Part 4 and Part 6. Again, we believe that this is a risk that can be mitigated through “self-responsible selection of exchanges”, “diversification of exchanges used”, and “thorough management of wallets and exchange balances”.

Needless to say, it would be one of the risks that I could deal with adequately for myself.

16. what to expect from bitcoin in the future

For now, it’s about spreading the word, isn’t it?

I would be very happy if it could be used anywhere in the world, especially when traveling, because it is convenient for small payments and because it is a currency that does not belong to any country, so there is no need to exchange money.

また、個人的には、アフィリエイトをビットコインで受け取れるようなしくみがもっと増えると嬉しいです。海外のサービスではいくつかあるようです。国内でもちらほら出来てきてはいるようですが、ソーシャルゲーム臭がするので、正直なところ今の時点では見送りたいところです。

Although it is not EC, if bitcoin becomes available for credit card points, frequent flyer miles, points at electronics retail stores, etc., the range of my own use will expand and it will become very interesting.

And, at the risk of sounding a bit technical and idealistic, in order for Bitcoin to have a greater impact on the real economy, the finance functions related to Bitcoin must be further developed. At the very least, bitcoin needs to be recognized as a means of raising funds through the issuance of bonds and stocks. There is also the question of what bitcoin interest rates are in the first place. In order to understand this, the ability to issue securities using bitcoin will be essential.

Once the recognition and liquidity are high enough to make such financing possible, it should lead to more advanced credit and derivative transactions using Bitcoin as the underlying asset. As I was writing this, it seems that bitcoin derivatives have already started to appear in various forms around last year.

Ex-Goldman, Paribas Execs Launch Bitcoin Derivatives Exchange http://www.coindesk.com/former-goldman-director-launches-bitcoin-derivatives-exchange/

TeraExchange Receives US Approval to Launch First Bitcoin Derivative http://www.coindesk.com/teraexchange-bitcoin-derivative-cftc/

The world is moving fast, the more I look into it, the more information I get…. This case is very interesting, so I will check it out and study it later, and put it together again.

17. finally: for now, even if it’s a little late, I’d like to try my hand at something trendy and see how it goes.

This is a bit longer than I expected, but I’ve tried to summarize my own approach to getting started with Bitcoin. Bitcoin is very attractive and ideal because it is completely independent of existing governments, nations, and financial institutions. I have a feeling that I will get hooked on it outside of speculation. (To be honest, I have little interest in investing.)

As always, I’m a sucker for tech trends like this. And even so, I don’t seem to have the sense to be able to jump on the cutting edge of trends at all, and I always feel like I’m slightly missing out. But fortunately, it still seems to be in its infancy, so I’m hoping that when it starts to spread widely in the future, I’ll be able to enjoy its convenience casually and without a care in the world.

Gox incident last year, there has been an excessive amount of talk about the risks involved and the need for strict security, which has raised the bar for the spread of Bitcoin. Enlightening people to understand how it works and how to deal with the risks in an easy-to-understand manner will be an essential factor in its spread.

We will continue to keep a close eye on Bitcoin-related news, but we also hope that it will be used in a wide range of applications, and that we will not be left behind in this trend.

18. list of reference sites and literature

- 旅行サイトのエクスペディア、Bitcoinでの決済に対応 – CNET Japan | http://japan.cnet.com/news/service/35049281/

- Booking flights with bitcoin: Taking off | The Economist | http://www.economist.com/blogs/gulliver/2015/02/booking-flights-bitcoin

- 野口 悠紀雄 | 仮想通貨革命—ビットコインは始まりにすぎない

- bitcoin.org | https://bitcoin.org/ja/

- bitcoin.org よくある質問 | https://bitcoin.org/ja/faq

- Bitcoin日本語情報サイト ? 仮想通貨(暗号通貨)ビットコインのチャート・入手・使い方等日本語解説サイト | http://jpbitcoin.com/

- Blockchain.info | https://blockchain.info/ja/

- BTCbox | https://www.btcbox.co.jp/

- coincheck | https://coincheck.jp/

- Quoine exchange | https://www.quoine.com/

- LocalBitcoins.com | https://localbitcoins.com/

- VirWoX | https://www.virwox.com/

- Bitstamp | https://www.bitstamp.net/

- CoinDesk | http://www.coindesk.com

- Ex-Goldman, Paribas Execs Launch Bitcoin Derivatives Exchange | http://www.coindesk.com/former-goldman-director-launches-bitcoin-derivatives-exchange/

- TeraExchange Receives US Approval to Launch First Bitcoin Derivative | http://www.coindesk.com/teraexchange-bitcoin-derivative-cftc/